February 26, 2025 - By : admin

February 26, 2025 - By : admin

Understanding Tariffs and Their Impact on Global Trade

At Shipspry, we believe in helping businesses navigate the complexities of international trade. One key factor shaping global commerce today is tariffs—taxes imposed on imported goods that affect supply chains, pricing, and overall market dynamics.

US President Donald Trump has announced a 25% tariff on all steel and aluminium imports. He has already introduced a 10% tax on all products from China – which has responded with its own measures – and has threatened to introduce tariffs on products from Canada and Mexico.

Trump says tariffs will boost the US economy and “protect” the country from illegal immigration and the flow of drugs.

What Are Tariffs and How Do They Work?

Tariffs are government-imposed taxes on goods brought into a country. The companies importing these goods pay the tax, which can be a percentage of the product’s value. For example, a 10% tariff on Chinese goods means a $10 item incurs an additional $1 charge. Often, businesses pass these costs on to consumers, leading to higher prices.

Recent Tariff Policies and Their Implications

The U.S. government has announced a 25% tariff on all imported steel and aluminum starting March 12, with no exceptions. Additionally, a 10% tariff on Chinese imports took effect in February, triggering retaliatory tariffs from Beijing. Proposed tariffs on imports from Canada and Mexico have been delayed but remain on the table.

Why Are These Tariffs Being Implemented?

U.S. officials argue that tariffs will strengthen domestic manufacturing, protect jobs, and increase tax revenue. The White House has also linked the measures to national security, citing concerns over illegal immigration and drug trafficking—particularly the flow of fentanyl from Mexico and China.

Impact on Trade and Supply Chains

How will the steel and aluminum tariffs work?

Trump says the 25% tariff on both metals will come into effect on 12 March, with no exceptions.

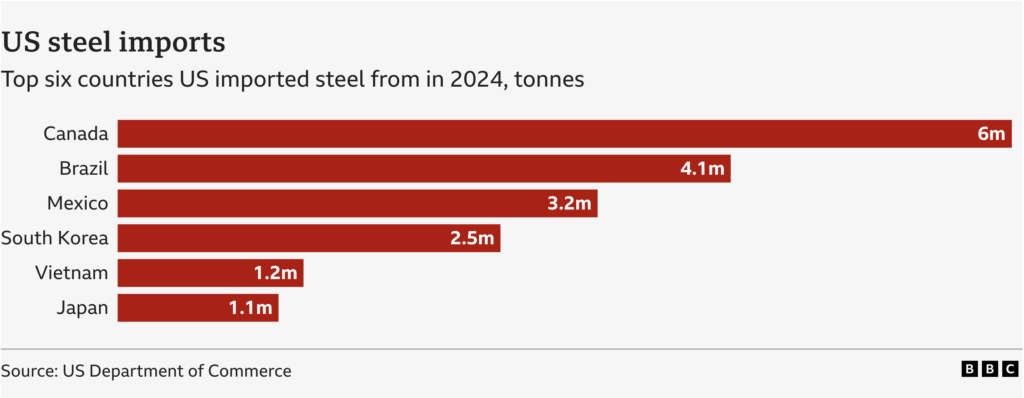

The US is the world’s largest importer of steel, with Canada, Brazil and Mexico its top three suppliers.

Canada also provided more than 50% of the aluminium imported into the US in 2024.

Shares of US steelmakers rose following the announcement. However, American companies which use steel and aluminium to make products have warned the tariffs could put their prices up.

The Canadian government said the tariffs were “totally unjustified” and vowed swift retaliation.

Trump previously announced tariffs of 25% on steel and 15% on aluminium in 2018, during his first term as president. However, he subsequently negotiated exceptions for many countries including Australia, Canada and Mexico.

Despite the exemptions, tariffs raised the average price of steel and aluminium in the US by 2.4% and 1.6% respectively, according to the US International Trade Commission.

What is happening with tariffs against China, Canada and Mexico?

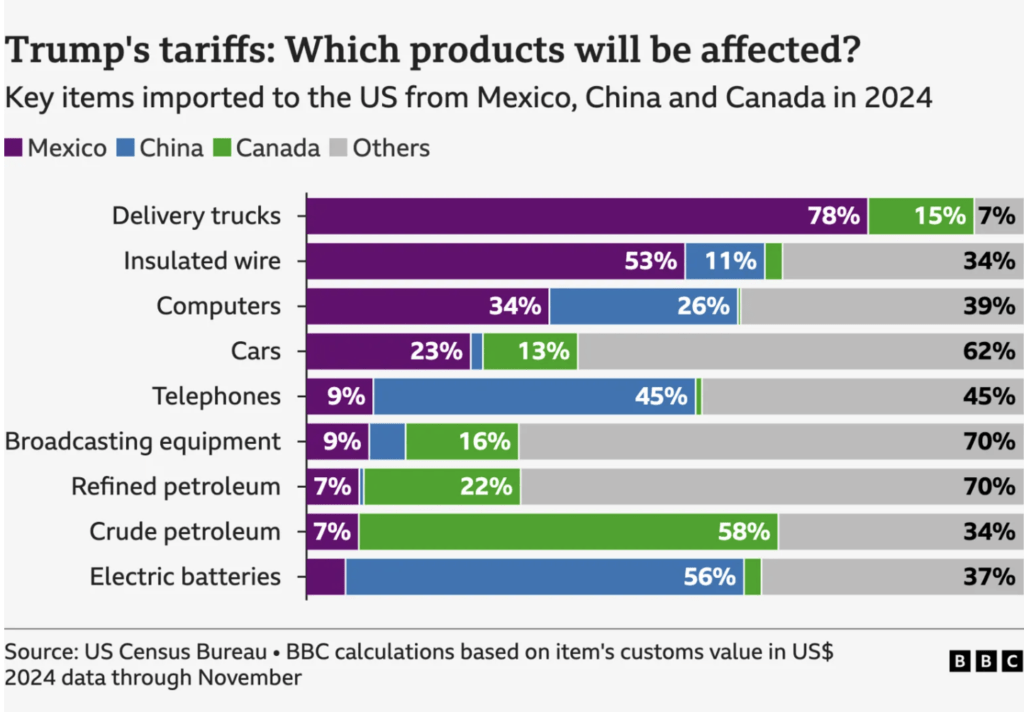

Together, China, Mexico and Canada accounted for more than 40% of imports into the US in 2024.

China

A 10% charge on all goods imported from China to the US took effect on 4 February. Trump then said shipments worth less than $800 (£645) would be exempt.

Beijing retaliated with its own tariffs, which took effect on 10 February. These include a 15% tariff on US coal and liquefied natural gas products, and a 10% tariff on crude oil, agricultural machinery and large engine cars.

China has repeatedly voiced its opposition to a trade war with the US.

Canada

A proposed tariff of 25% on all goods entering from Canada was also due to begin on 4 February. However, this was delayed for 30 days.

Canada also paused its own retaliatory tariff of 25% on 155bn Canadian dollars’ worth ($107bn; £86bn) of US imports.

PM Trudeau said Canada was implementing a “$1.3bn border plan” to add “new choppers, technology and personnel to border,” as well as “increased resources to stop the flow of fentanyl”. Much of the border security plan had already been announced.

Trump said the delay would allow the US to see “whether or not a final economic deal with Canada” could be reached.

Mexico

The proposed 25% tariffs against Mexico have also been delayed a month, as have new measures by Mexico against US goods.

Mexican President Claudia Sheinbaum agreed to send 10,000 members of the National Guard to the US-Mexican border to “prevent the trafficking of drugs, in particular fentanyl”.

Sheinbaum said the US had in turn agreed to increase measures to prevent the trafficking of high-powered US weapons into Mexico.

Which products will be affected and will prices increase?

All goods from China worth more than $800 are covered by the 10% tariff.

Economists warn that firms selling imported goods are likely to increase prices for US consumers, to cover the cost of the duty.

If the measures against Mexican and Canadian imports go ahead, items they produce are also expected to become more expensive.

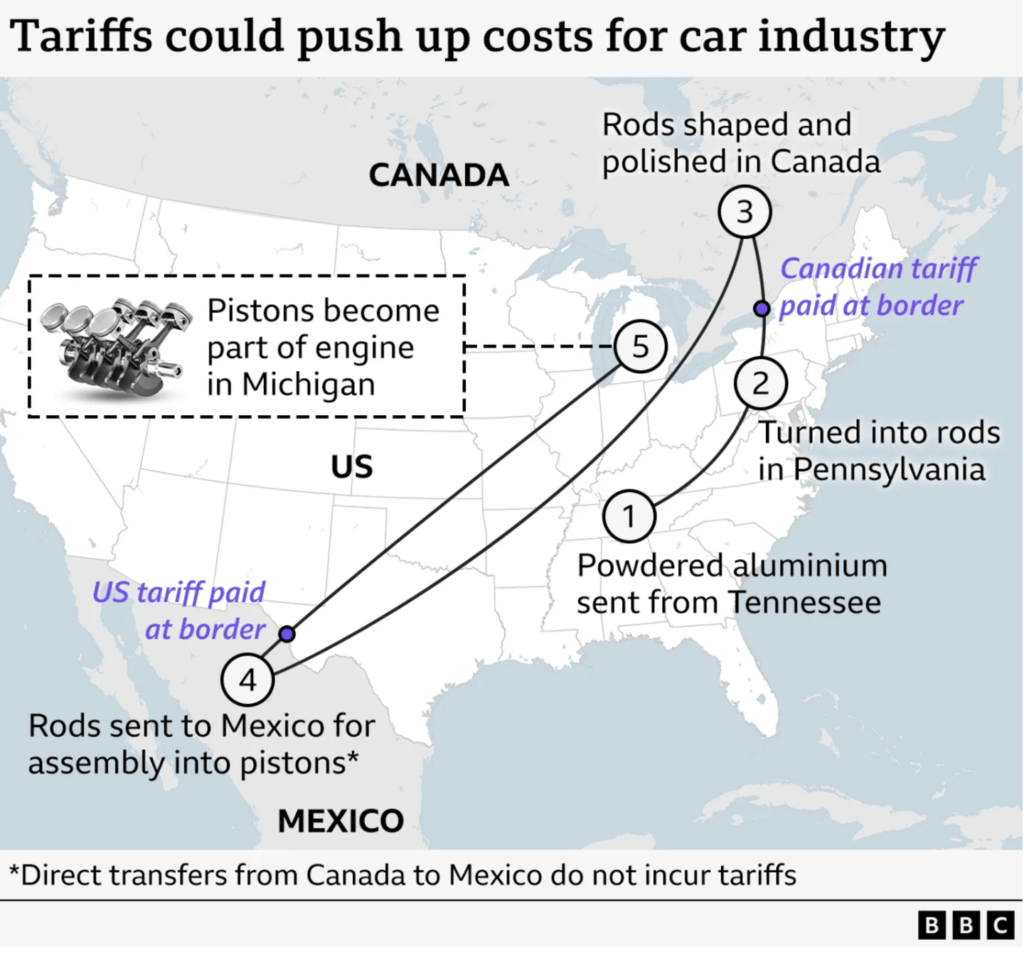

Car manufacturing could be hit extremely hard. Vehicle parts cross the US, Mexican and Canadian borders multiple times before a vehicle is completely assembled.

The average US car price could increase by $3,000 because of the import taxes, financial analyst TD Economics suggested.

Other goods from Mexico which could be affected include fruit, vegetables, spirits and beer.

In addition to steel, Canadian goods such as timber, grains and potatoes are also likely to get more expensive.

Canadian energy would face a 10% tariff instead of 25%.

US tariffs on imported washing machines between 2018 and 2023 increased the price of laundry equipment by 34%, according to official statistics. Prices fell once the tariffs expired.

Some experts suggest that Trump’s new round of tariffs could prompt a wider trade war which could put prices up more generally.

Capitol Economics said the annual rate of US inflation could increase from 2.9% to as high as 4%.

Will the UK and Europe have to pay tariffs?

Trump previously told the BBC the UK was “out of line”, but suggested a solution could be “worked out”.

The UK exports pharmaceutical products, cars and scientific instruments to the US.

Business secretary Jonathan Reynolds said the UK should be excluded from tariffs because it buys more from the US than it sells there.

Speaking in Parliament after the announcement of the steel and aluminium tariffs, Trade Minister Douglas Alexander said the UK would not have “a knee-jerk reaction” but “a cool and clear-headed” response.

Trump also said he was considering imposing tariffs on the EU because “they take almost nothing [from the US] and we take everything from them”.

In 2024, the US had a trade deficit of $213bn with the EU – which Trump described as “an atrocity”.

European Commission President Ursula von der Leyen strongly criticised the new steel and aluminium levies.

“Unjustified tariffs on the EU will not go unanswered,” she said.

US companies Harley Davidson, which manufactures motorcycles, and whiskey distilleries such as Jack Daniel’s have previously faced EU tariffs.

What Does This Mean for Shippers?

For businesses relying on global logistics, tariffs introduce volatility—affecting costs, inventory planning, and market competitiveness. Companies may need to reassess their supply chain strategies, explore alternative sourcing options, or leverage efficient air freight solutions to minimize disruptions.

At Shipspry, we stay ahead of industry trends, ensuring that businesses can adapt quickly to shifting trade policies. Our expertise in air cargo logistics helps customers optimize their supply chains, reduce transit times, and navigate the complexities of international trade with confidence.

Want to stay informed on the latest trade developments? Follow Shipspry for insights and solutions that keep your business moving.

Source: BBC News